I provide optional contactless small business tax return preparation and e-filing services. I am also a QuickBooks ProAdvisor. For contactless returns, I have a secure file that I will invite you to send and receive confidential documents, as well as electronically signing engagement letters and tax forms. Whether your company is a C corporation, S Corp, Limited Liability Company, Non-profit, Partnership or Sole Proprietor, a properly prepared tax return can be filed to minimize the tax owed. I have hands on experience in all aspects of a small business, and I have a passion to help small businesses grow.

Check the MENU tab for prices and the About Me tab for more information.

IRS links:

https://irs.treasury.gov/rpo/help_ea.html

https://irs.treasury.gov/rpo/rpo.jsf

What is the difference between a CPA and an enrolled agent?

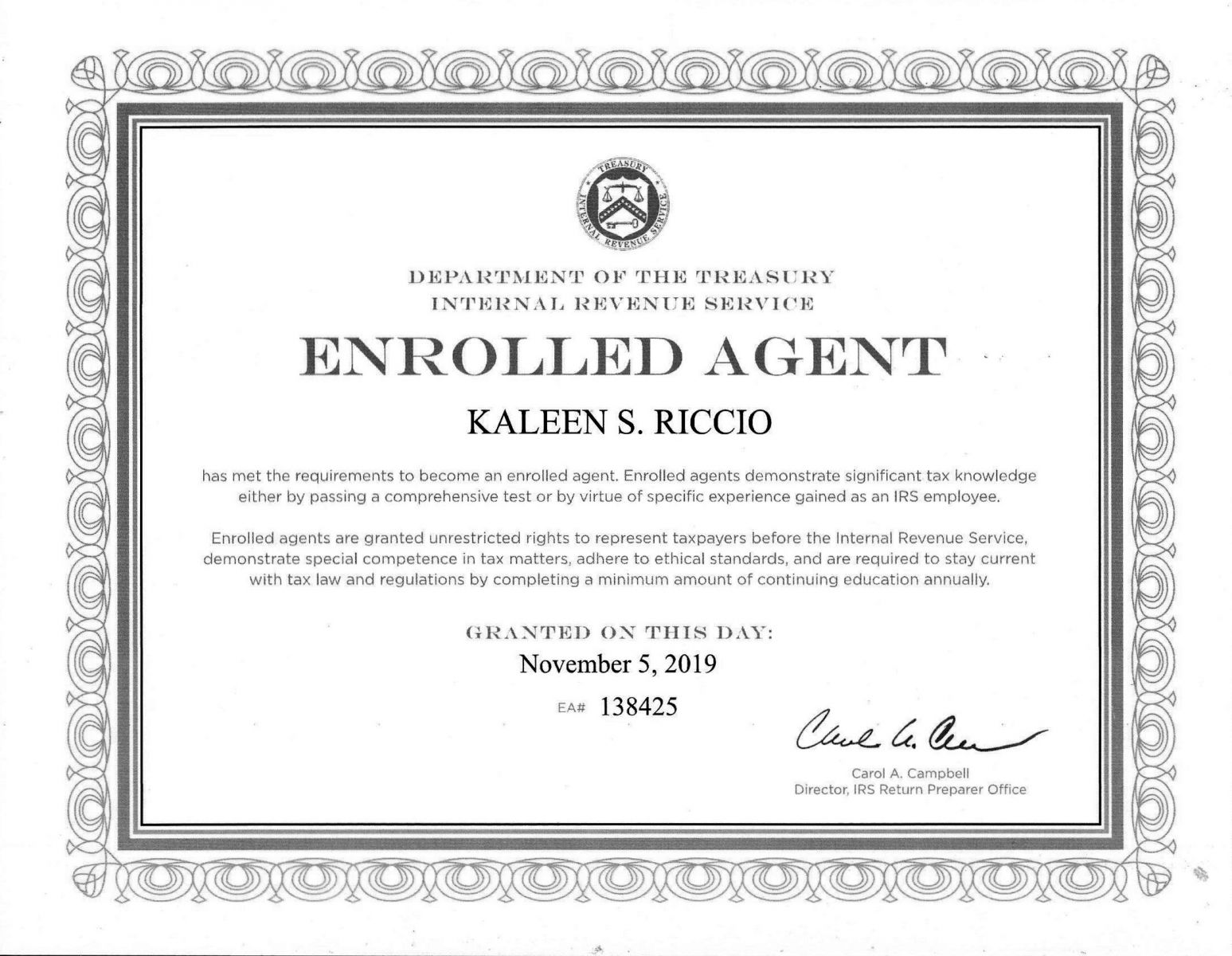

An enrolled agent is a tax practitioner who is licensed at the federal level by the Internal Revenue Service. In fact, enrolled agent status is the highest credential awarded by the IRS. On the other hand, certified public accountants are licensed by their applicable state boards of accountancy.